The Best Budgeting and Expense-Tracking Apps For Travelers

We may earn a commission from purchases you make after clicking links on this site. Learn more.It happened one sultry afternoon in the buzzing city of Bangalore, India. I was queuing to purchase my first overnight train ticket, there was only one woman in front of me, and I was rummaging through my wallet. Where the hell were those two 500 rupee notes I had taken out of the ATM just… one, two days before?

Luckily there was a heated discussion going on at the counter, so I had a little more time… to realize, right, I went out for dinner with my friend. And then we grabbed drinks. And then I paid for the taxi home. And so on. And now I had only a few rupees left.

So while I was running to the next ATM, I also decided it was really time to do something about tracking all the money flowing out of my pockets. I already used a few tools to manage my finances on the go, but I really had to focus on budgeting if I wanted to stay on the road much longer.

I started researching budget-tracking apps, and as soon as my weak Wi-Fi connection allowed, downloaded and tried them out. Here’s my experience, and what I found to be the best apps for tracking your budget while traveling.

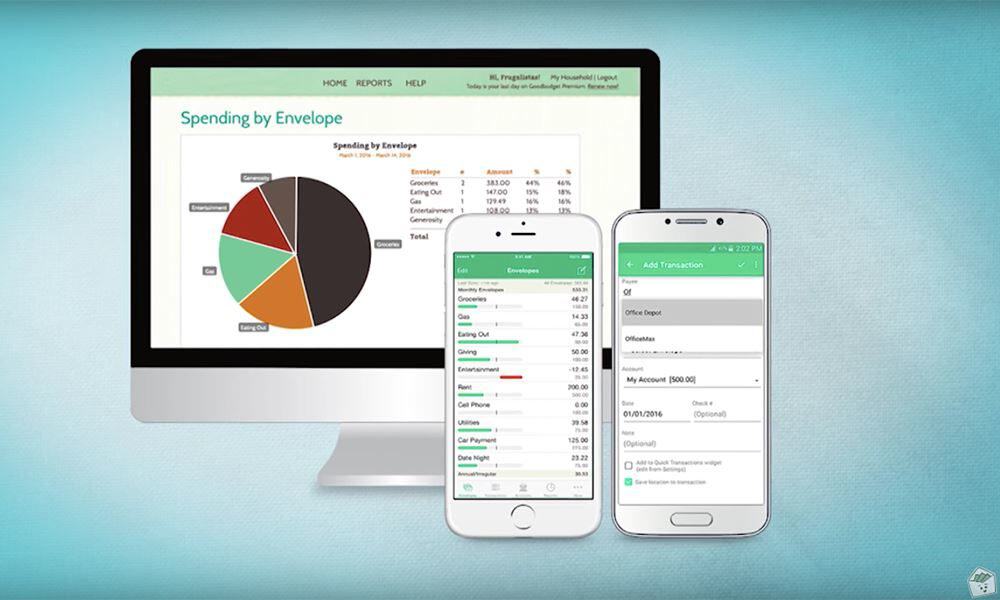

Goodbudget

Goodbudget uses the concept of “envelopes” to help you manage your funds. You start by creating the categories you’ll spend money on, then assign a certain budget to each of them in advance, much like putting money in physical envelopes to keep it separate.

This way, you plan ahead instead of just tracking. Of course, it only works if you stop spending after reaching your personal limit! Envelopes can be marked irregular, recurring, or used for specific, expensive items like flight tickets or a new laptop.

There’s a forever-free version with 20 envelopes and one-year history, available for both Android and iOS. You can upgrade to get unlimited envelopes, five years of history, and more for $6/month or $50/year.

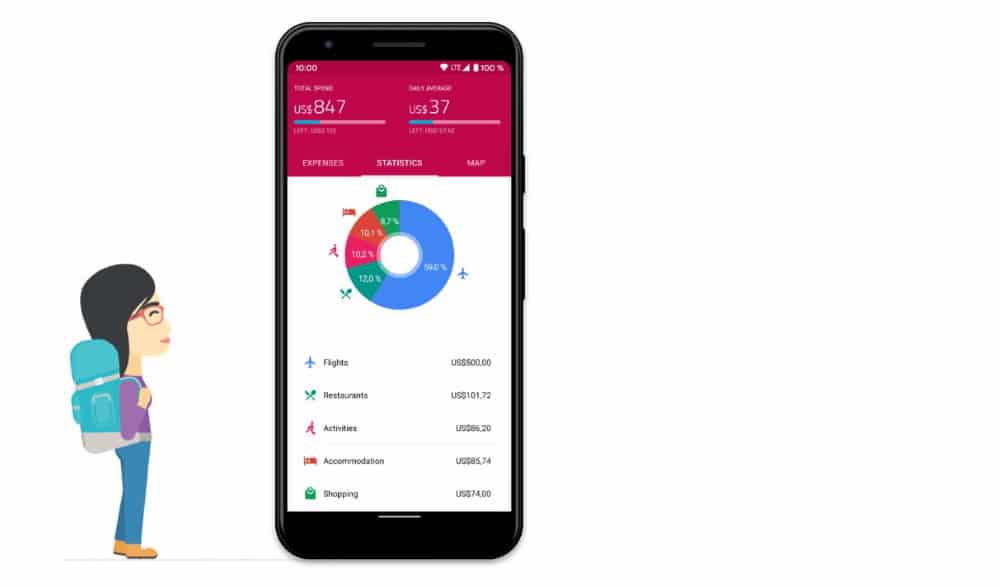

TravelSpend

TravelSpend feels like it’s been designed by people who’ve actually spent time on the road. The iOS and Android apps are designed to work entirely offline, and you can also add expenses in any currency that get automatically be converted to your home or default currency.

There are pretty graphs to help you see where your money is going (food and drink, if you’re anything like me,) and you can see your total and daily average spend at a glance. You can even tag your purchases with the places you made them, and seem them laid out on a graph.

The basic app is free, but if you splash out for the premium version, you’ll get a bunch of other features. You’ll gain the ability to split costs with other travelers, create custom categories, track credit card as well as cash payments, export your data to a CSV file to use in a spreadsheet or elsewhere, and plenty more.

The premium version costs $3.99/month, $17.99/year, or $35 for a lifetime subscription.

Mint

Mint is a full-blown money management tool, meaning it includes your income as well. You can sync with your bank accounts to automatically track all your electronic transactions, while still being able to add cash spendings manually.

It shows your monthly budget, account totals, and credit score, with all expenses organized by category and alerts when you exceed your budget. And the best: It’s free! In exchange for ads, of course.

Hands down, Mint is an effective all-in-one finance manager, and available on iOS and Android. If you want a really comprehensive tool, it’s a great choice, although some people may find its wealth of features more than they need.

It’s designed for users from the US and Canada only, however. Spendee, below, is a good option for those not from North America. An alternative is Personal Capital, which is quite similar.

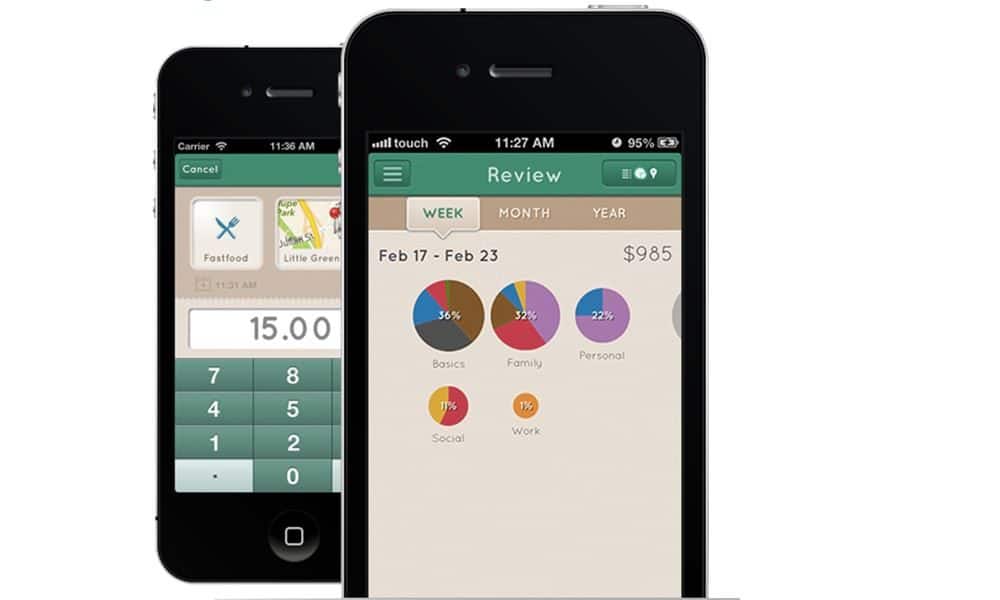

Wally

If connecting your bank account to an app doesn’t work for you, either for security reasons or because the option isn’t available in your country, Wally allows you to enter everything manually. In a lively interface, you can easily set a savings target, organize everything in categories, and set recurring income and expenses.

The app can track your location, making manual input even easier, and creates a few infographics of your spending. If you’re in a hurry, you can simply take a photo of your receipt. However, changing currencies is more of a hassle (you always have to navigate to the settings), and once done, will change all your other expenses to this currency too.

If you’re looking for a broad overview of your finances with not too much detail, this is the app for you. Wally is available for free on iOS and Android. If you want nothing but the facts and don’t need pre-defined categories and pie charts, Fudget is a simple, efficient alternative.

Spendee

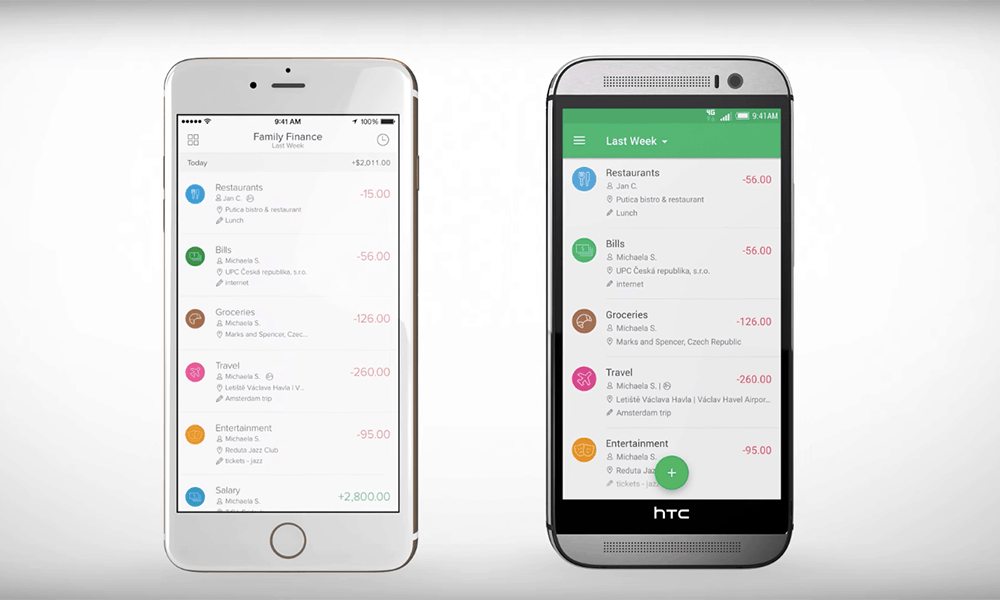

With a user-friendly, brightly-colored interface, customizable categories, all the details I need to track my budget without being too complicated, and one of the few apps that allow me to add my Germany-based bank account (even if only available for premium users), I love Spendee!

You can change currency directly while adding an income or expense, quickly access different categories, save photos of receipts, and get pretty infographics to view your spending over time. Additionally, you can create a budget that helps you achieve your financial goals.

The basic version is free for iOS and Android. Upgrading to Premium lets you connect your bank account, create multiple wallets for different trips or projects, and create unlimited budgets for $2.99 per month.

Toshl Finance

If you want to track your finances beyond just travel, Toshl is another favorite. It lets you connect up to two financial accounts for free, inside and outside the US. Like many other apps, you can automatically pull in transactions from your account or manually add any income or expense. Additionally, it analyzes your spending habits to create a budget plan for the future, while also suggesting possibilities for investment.

The basic plan is available for free on iOS and Android, while the advanced plan with unlimited accounts and budgets costs $1.99 per month. If you need the big picture, want to analyze your finances and plan your budget ahead in a very detailed way, this is the way to do it.

Get regular updates from the world of travel tech and remote work

News, reviews, recommendations and more, from here and around the web

Also Worth Mentioning

If you’re more of a timeline kind of person, Dollarbird offers similar manual features to Wally, while displaying your income and expenses on a calendar. For the business-oriented travelers and digital nomads among you, Expensify might be worth a shot. It lets you save receipts, plus track driven miles and time for hourly earnings.

Want to keep it even simpler than downloading an app? It’s worth checking with your bank, since many offer personal budget tracking tools already. In the end, if you can’t find anything else you like, even a spreadsheet does the job (Microsoft offers a useful template here.)

And the Winner Is…

You should be able to find something that works for you from the list above, from basic tracking of expenses in apps like Trail Wallet to a full-blown financial planner like Toshl.

As mentioned above, I’ve settled on Spendee (the free version). I don’t need a totally comprehensive tool like Toshl, nor do I currently need to connect to my bank account. With Spendee, I can easily choose currencies, include income and expenses, select recurring transactions, all with a fun-to-use design.

Images via author (header image), developers (other images)