A Review of Wise (formerly Transferwise) for Travelers: What’s It Really Like?

We may earn a commission from purchases you make after clicking links on this site. Learn more.Currency exchange is the bane of my traveling life.

I recently headed to Sweden for a long weekend, but my flight actually landed in Copenhagen. On a whim, I decided to explore the city for a few hours before heading over the border.

After landing and trying to purchase a train ticket into the city, though, I realised that although I had Swedish krona, I hadn’t thought about getting any Danish krone. Oops.

I had to convert some money at the airport, taking a big hit on the exchange rate in the process. It was a stupid mistake, but one that travelers often make.

We all know the struggle of withdrawing and exchanging foreign currency, trying to make sure you’re not getting screwed over by your bank on the one hand, or the bureau de change on the other. It’s an expensive hassle (if a huge privilege, I’ll admit.)

When I stumbled upon Wise (formerly Transferwise), a well-regarded money transfer service and online bank, it seemed to be a traveler’s dream.

The company’s basic premise is a simple, low-cost way of sending, spending, and receiving different currencies, eliminating bad exchange rates and high bank fees along the way. It was set up by two Estonians, Kristo Kaarman and Taavet Hinrikus, back in 2011.

You’re able to send money to bank accounts in around 160 countries, hold funds in 40+ currencies, and get your own bank account details to receive funds in a range of different currencies including USD, GBP, and EUR.

Even better, residents of over two dozen countries are able to withdraw or spend those funds in over 150+ countries at very low costs, using a Wise debit card.

I’ve been putting it all to the test.

What is Wise?

Wise takes a smart approach to converting money, one which can be (and usually is) dramatically cheaper than using than a high street bank.

The company explains that instead of one international transfer taking place when doing the conversion, two local transfers are made instead. In doing so, it simply bypasses most international fees.

For example, if you want to switch dollars to euros, Wise will send your dollars to its USD account in the US, and your euros from their euro account in Germany. This saves the company money as the converted cash hasn’t traveled internationally, and it passes those savings on to you.

Even better, Wise uses the real, mid-market exchange rate, which is the same rate that banks use to trade between themselves. That’s a much better rate than banks offer their customers, or what you’ll get at your local currency exchange kiosk, and the company promises never to mark it up.

How Wise Works

If you’ve never used Wise before, you can see how it all works before needing to set up an account. Just go to the website and plug in how much money you want to transfer, and into which currency. You’ll then see how exactly what the converted amount will be, along with the transparent fee.

To actually send the money, you’ll need to set up an account. You can create it using Facebook, Google, or your personal or business email address.

The best aspect of Wise is that everything is shown upfront, without hidden costs and dodgy exchange rates. Instead, you get charged a fixed fee plus a percentage of the amount you’re sending, based on your payment method and chosen currencies.

It’s worth checking out the pricing page to find out more. While bank transfer is the most common (and cheapest) way to send money, it can also be done by debit card, credit card, or SWIFT payment for certain currencies.

A payment often takes one working day or less (sometimes, much less), which is much better than the few days taken by most banks! You’ll get email notifications along the way.

Why the Multi-Currency Account Is Perfect for Travelers

If you travel regularly or earn money in other currencies, there’s another feature of Wise that’s even more useful: a multi-currency account.

The account itself is free, and easy to set up once you’ve created your Wise account. It’s currently available to residents of the UK, Switzerland, United States, Canada, Australia, New Zealand, Singapore, several European countries, and elsewhere.

After choosing your preferred currencies, you’ll be issued with appropriate bank account numbers where possible. Currently, Wise hands out UK, Belgian (euro), Polish, US, Canadian, Hungarian, Romanian, Singaporean, Australian, and New Zealand bank details, letting you receive money in those currencies no matter where you’re based.

You can hold dozens of other currencies in your account as well, and it’s easy to switch money between them. You can also see the current balance in each account, all on one page. Wise uses its usual mid-market rate when moving money around, and charges a percentage on the conversion.

Wise Debit Card: Spend at the Real Exchange Rate

Once you have your account, in most cases you can request a bank card to go with it. There’s a one-time setup fee of £7 or the local equivalent.

Having used Wise a lot for sending and receiving money, I jumped at the chance to test out the card as well. I’ve paid my share of high bank fees in the past, after running out of money abroad and having to pull out cash with my UK debit card. Being able to spend money in multiple currencies without having to worry about extortionate rates seemed like a dream come true.

So far, honestly, it is.

You can use the Wise debit card anywhere displaying the Mastercard logo, or with Apple Pay or Samsung Pay. If you’re spending in a currency you already hold in your account, there’s no cost. If not, Wise will auto-convert from whichever balance has the lowest cost. You’ll typically pay between 0.35-1%, plus a small fixed fee. More on the company’s fee structure here.

If you use your Wise card to do a cash withdrawal from an overseas ATM, you can do up to two transactions for a total of up to £200/$250 for free, every thirty days. After that, you’ll pay 50p per transaction, and once you get above that £200 threshold, 1.75% of the transaction amount.

In the early days of using the card overseas, I found myself hitting that threshold regularly. As card payments have become increasingly common around the world in recent years, however, it’s become far less of a concern.

Using this card is as simple as using any other debit card. It’s also “chip and PIN” and contactless, a useful feature that really speeds up low-value card transactions.

I’ve used my Wise debit card in a bunch of different countries while traveling, and as well as making things easier and cheaper, it’s also been a pretty efficient budgeting tool. I’d simply put a certain amount of money into my account in advance, then use this card for every transaction.

At the end of the day, all of my transactions are in front of me in the app and on the website, tagged with the name of the store I spent my money in. With card payments becoming the norm in many countries, it’s easier to use my card than mess around with physical cash.

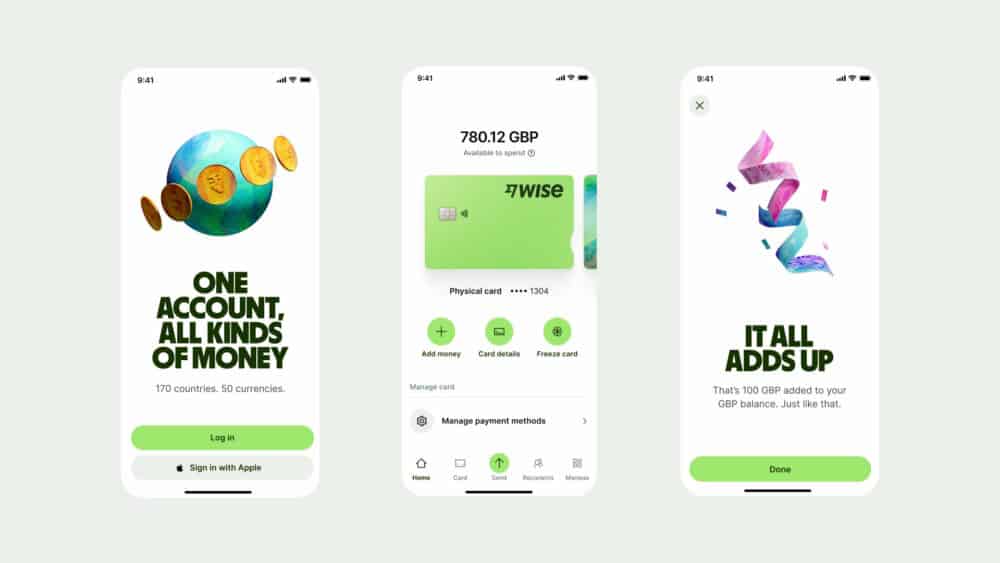

On the Go with a Mobile App

At the risk of gushing too much about this service, my final point is about the convenience of that mobile app.

It’s especially useful when paired with the Wise Mastercard, since as soon as you’ve paid for something with the card, you get a notification on the mobile app telling you about it. That’s great for both security and budgeting, since it tells you both how much you spent, and how much you’ve got left in that currency account.

You’ll also get a notification every time funds arrive in your Wise account. If you’re a freelancer or business that regularly gets paid via Wise, it’s a notification you’ll soon come to love!

As well as your spending, all other transactions can be viewed on your phone, and it’s simple to convert or send money from there as well. Better yet, if you’re someone who regularly forgets their PIN (ahem,) it’s easy to find in the app.

Is It Safe?

The company guarantees to keep your money safe, and it’s regulated by the Financial Conduct Authority in the UK, and various state authorities in the US. With over five million customers and moving more than four billion dollars a month, it’s a serious business.

You can email or call with any concerns, but there’s no branch to walk into if there’s a problem. This may worry some people, especially if the company is slow to reply to queries. I’ve personally had problems with this, but it seems that most people don’t, since reviews of the support experience are overwhelmingly positive in this regard.

The company also has a relatively short track record compared to most banks, so although my experience so far has been very positive, I don’t keep much money in my borderless account. Instead, I just transfer it in as and when I need it.

Get regular updates from the world of travel tech and remote work

News, reviews, recommendations and more, from here and around the web

Conclusion

Ultimately, I really like what Wise is doing. If you’re a traveler, the website, app, and debit card are saviors when it comes to converting cash and spending overseas. I’ve saved a small fortune on bank fees already.

Even if you don’t travel much, it’s an easy way of saving money any time you need to send or receive a foreign currency. The costs are typically a fraction of what regular banks charge for the same service, and receiving the “real” exchange rate makes a huge difference on larger transactions.

I’m a fan!

Have you used Wise (or Transferwise), or got any questions about it? Let us know in the comments!

Main image via stevepb, other images via Wise

Hi Hanna,

Helpful article!

Can you set up a borderless account from anywhere? For example, if I’m in Canada (no CAD account available yet from Transferwise), but want a USD account, do I have to be resident in the US? (That’s how it is for most accounts offered by banks.)

Also, once you’ve used the £200 limit for free withdrawals on international ATMs, what’s the fee?

Thanks!

Eric

Hi Eric,

You can set up a USD account (with US bank details) as a Canadian resident, no problem.

Canadian residents aren’t yet able to get a debit card, but for those who are, once you hit the £200/$250 limit per 30 days, there’s a 2% fee.

Without getting the special invite, and the card, this seems pretty worthless. How do you get your money out of the transferwise account after you’ve converted it to the local currency? If you have the card, does it charge International transaction fees? I’ve been using transferwise for a while now, but for the life of me, I cannot see how I would use it for travel.

There’s no invite required now — other than Canadians, if you have a borderless account, you can just request a card.

There are no transaction fees for paying by card overseas, but there’ll be a currency conversion charge if you’re spending in a currency that you don’t currently hold in your account. There’s also no fee for the first £200/$250 (equivalent) of ATM withdrawals per 30 days, and 2% after that.

Any chance of having an invitation? I’m doing a big trip next month’s all over Asia and Europe and I’m looking for good travel cards… Revolut and Monzo are not a option right now since I’m in Australia, and I’d like to try Transferwise card (I have been using it for international transfers but need the card now !!!)

Need more detail. Like, if you’re using the TW debit card at a foreign ATM does TW reimburse you for the local ATM fees?

Incomplete. Still don’t see it working for travellers. Certainly does work for expats who have local bank accounts.

No, you won’t be reimbursed for local ATM fees. Even so, given the better exchange rates you get with Transferwise, you may still save money on the overall transaction. It’ll depend on your specific bank.

Given there’s no cost to getting the Transferwise card, it’s the kind of thing you could test out by doing a couple of withdrawals from the same ATM, one with a card that reimburses you for local fees and one with the Transferwise card that doesn’t, and see how much money leaves your accounts in the end.

Wouldn’t it be better to just get a bank card with no foreign transaction fees and atm reimbursement? Then you could just travel around using ATMs to get money out in the local currency and use the card without fees?

Correct me if I’m wrong but I’ve been trying to figure out why this wouldn’t be better?.. because the $250 atm

withdrawal limit without fees is way too low.

Those bank cards tend to make up for the lack of fees by giving you a poor exchange rate, while Transferwise gives the wholesale rate. In my experience the difference in exchange rate has been higher than the ATM fee, but you’d obviously need to compare specific cards to see which is best for you.

It’s great until they decide to deactivate your account without so much as a word to you. Then they hold your money, pending “due diligence Investigations” without any communication.they do not tell you what the due diligence process is or why your account is deactivated. This is NOT safe, I am without money because I got my income paid into the account and for nearly 3 weeks they hold it and I hear nothing. They are rude and I wish I had never used them.

so what’s the problem with issuing the debit card to Canadians ???? Why do THEY need an invite?

Please explain this

That’s really something you’d need to ask Transferwise – I don’t know what regulatory restrictions and business decisions went into that, or whether it’ll change in the future.

Why do they not do Saudi Arabia currency?

That’s a question for Transferwise, I’m afraid – it’s not something we can answer.

I wouldn’t recommend TransferWise at all. I’ve been using their account and their debit Mastercard for about one year with only some minor issues like they raised the fees constantly, some transfers have taken extraordinarily long or that some businesses (e.g. Decathlon Thailand, Thai Railways) refusing payments with the TransferWise Mastercard while accepting other Mastercards issued by reliable banks. But now, as I am travelling in Vietnam, within 2 weeks 3 card transactions (2 ATM withdrawals and one terminal payment at a hotel) failed, however the money was withdrawn from my account anyway. The money was blocked while the status of the transactions in the app was displayed as pending. Even though the money was actually refunded after exactly seven days (for the last ATM transaction im still waiting), it was gone at first and I had to get some emergency money on my other Mastercard. Their customer service didn’t help, not even regarding the special situation during the Coronavirus crisis.

In fact, you can save some money with TransferWise, but because it’s not really reliable, you always should have other options if you don’t want to risk standing in the middle of nowhere with no money left at all and no help from TransferWise’s customer service. I won’t use TransferWise anymore.

I had exactly the same problem with an ATM withdrawal in Vietnam with a debit card (not issued by Transferwise) — money taken out of the account but not given out by the ATM. Like you, I got the money back in the end, but it didn’t happen straight away. Not sure this is a Transferwise issue to be honest.

Hello, I travel a lot to Netherlands, but MasterCard and Visa are not widely accepted; I need a maestro card. Do you know if I can get one, or even a virtual one via transferwise, or any other platform you know of?

Thanks

Tom

I don’t know of anywhere that will give you a Maestro card, unfortunately.

That said, when you talk about Visa and Mastercard not being widely accepted, I’m not sure it’s quite as clear cut as that. I’ve never had problems using a UK or EU-issued Visa or Mastercard debit card in the Netherlands, for example, and my brother (who’s been living in the Netherlands for many years and runs a retail shop there) says that while credit cards aren’t all that common and there can be problems with foreign credit cards in particular, chip and PIN debit cards from those networks are widely used and accepted, at least in areas that see a reasonable number of tourists.

Since Transferwise will give you a euro account issued in Belgium, on a Mastercard debit card, I suspect it’d be less of a problem than (for example) a US-issued credit card. Maybe worth a try?

One of my EU clients is going to use Transferwise to pay me – I presume that goes direct to my bank account and then I still get hit with the conversion loss. They say it is cheaper for them to pay me this way. If I had a TFW euro account and they paid into that how would I then get that money into my UK account – I’d still have to convert it I guess and there would be fees. Their website is not very transparent on how you recover money from TFW account to your working UK account if you are only using it to get paid in Euros. Sorry if I’m missing something here.

That’s correct – if you get paid into a euro TFW account, you then need to pay some or all of the amount out into your usual GBP account and pay the standard fee when you do. The alternative is to get a TFW debit card and spend the euros directly, but that’s only helpful if you have expenses in euros.

Without a debit card, can one use one’s foreign currency to pay for services like flights etc.?

I cannot get a debit card in my country as yet but am using Wise to transfer across borders already.

Not unless the merchant lets you pay by direct deposit into their bank account (which is very rare, but not completely unheard of.)

Hi I had money transferred from my account through TransferWise on the 6th April 2021 . I’ve tried to find out what happened to my money by going into my emails . And I couldn’t get any help at all . What can I do ? . I have no money ; I NEED HELP . Maryanne.

You’ll need to contact Wise about this — there’s really nothing that anybody else can do to help. There’s a contact button at the bottom of this page, although you’ll need to be logged into your account to use it.

What happens incase they become insolvent?

Who actually regulates them?

They’re regulated by the FCA in the UK, and the equivalent regulatory bodies in many other countries. That means that (in the UK) you’re protected up to £85,000 per account, as with other banks etc that are also regulated. I can’t speak for what the protections are elsewhere – you’d need to look that up based on where you live – but if it’s regulated in the same way as other financial institutions in your country, you should have the same amount of protection.

After 3 successful transactions from India to the US, on the 4th attempt they are charging hefty fees. Why? Is there a cap on certain number of transactions per month?

Not that I’m aware — I send probably 5-10 payments a month through Wise (not from India to the US, though), and the fees just scale up and down with the amount of money I’m sending.